A professionally managed portfolio of high-quality commercial properties, available to retail investors.

PMG’s retail funds provide investors with a professionally managed portfolio of commercial properties intended to deliver regular income and the potential for growth in the value of your investment over time.

Designed for those with a long-term outlook, these funds offer passive income while enabling wealth accumulation through diversified property exposure.

*Data as at 31 December 2024 for retail funds only. Past performance is not an indicator of future results. Weighted average, rounded to the number of significant figures shown.

Our retail funds focus on long-term growth by leveraging strategic diversification, conservative borrowing, and tax-efficient* structures to optimise returns.

We mitigate risk by investing across different property types, tenants and locations nationwide.

Our disciplined debt strategy supports fund stability, helping us navigate market cycles with confidence.

As Portfolio Investment Entities (PIEs), our retail funds may offer tax benefits that enhance net cash returns for investors.

*Tax benefits depend on individual circumstances, please consult a tax professional.

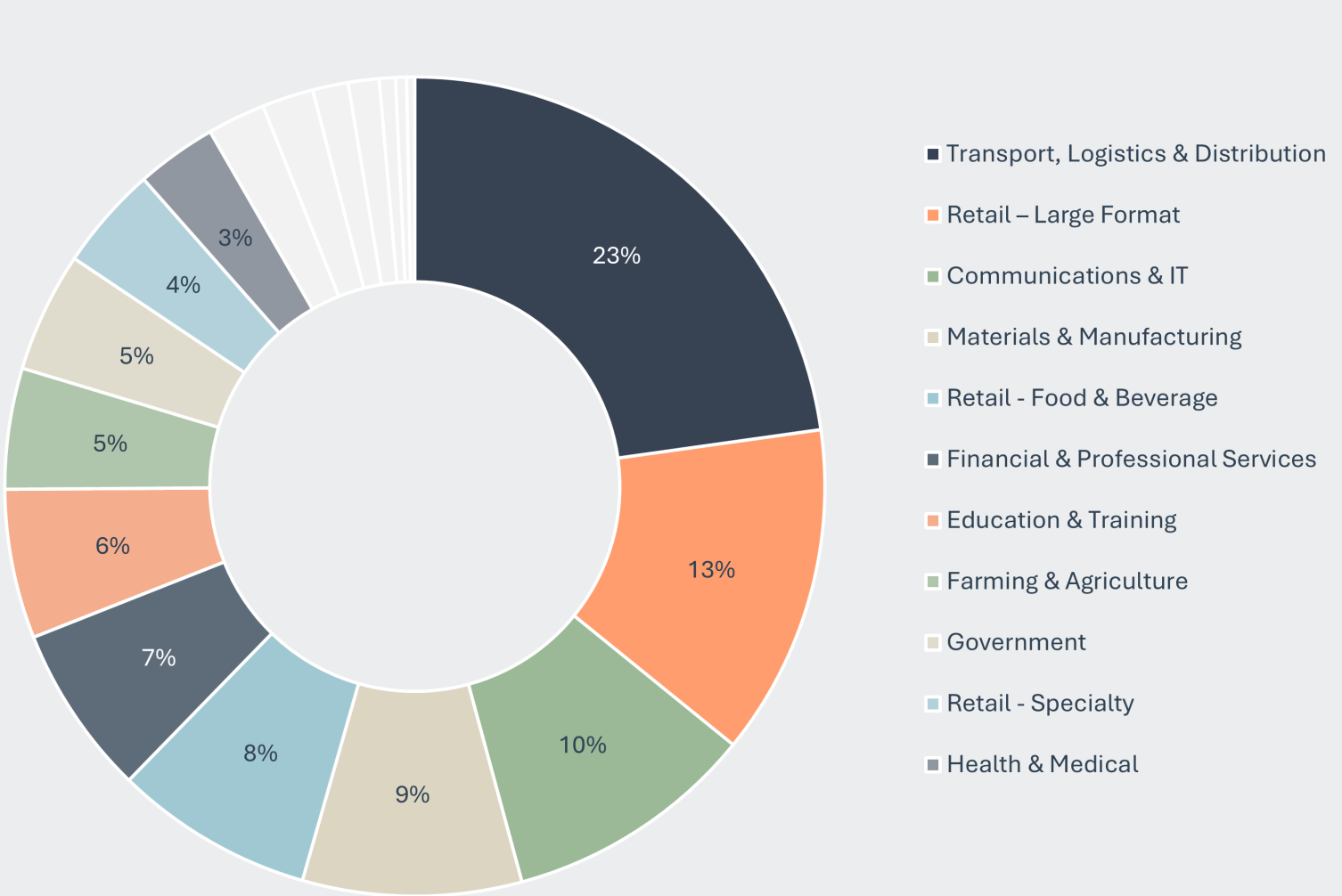

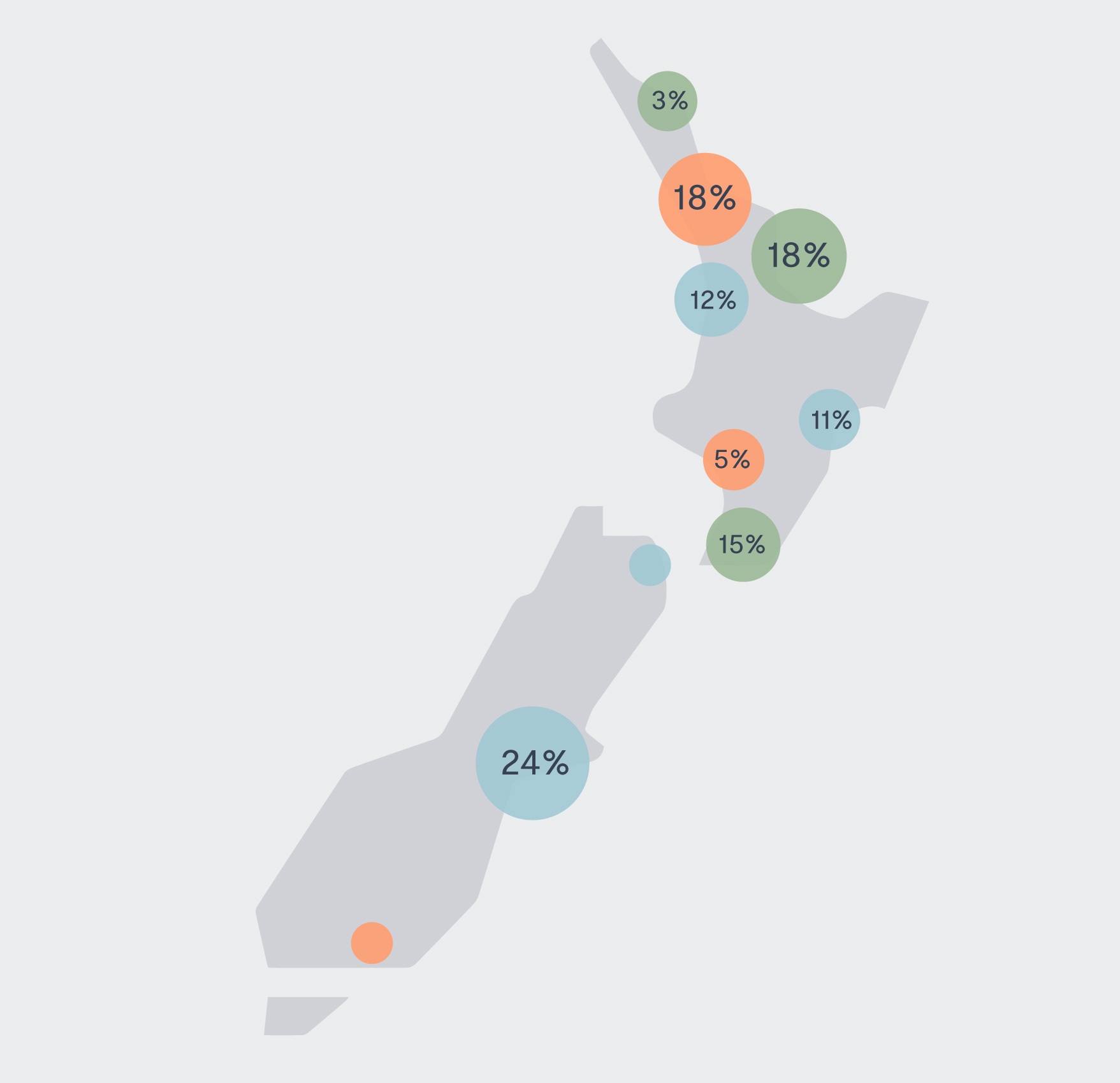

PMG invests across diverse property types, locations and tenant profiles. This approach helps our funds remain resilient by strengthening our portfolio against market fluctuations, and helping to mitigate risk against challenges affecting individual properties, sectors or regions.

Rental income diversification from PMG’s retail fund portfolio as at 31 December 2024.

The residual 7% of income by tenant sector is from a variety of sectors.

PMG's four unlisted retail funds are designed to deliver regular returns and long-term capital growth through strategic diversification across property types, locations, and tenant profiles.

Established in 2014, Pacific Property Fund is PMG’s

largest directly held commercial property fund. The

Fund includes a number of high-quality properties in

the industrial property sector, which has demonstrated

continued growth and resilience.

*Data as at 31 December 2024. Past performance is not an indicator of future results

To target sound and well-located industrial, office and retail properties across major metropolitan and regional centres of New Zealand, that offer sustainable returns.

To develop a resilient, diversified portfolio of quality industrial, office and retail properties across New Zealand with robustness of scale that can deliver

sustainable cash distribution returns and growth in value over time.

$447m

Total portfolio value

99%

Portfolio occupancy

38%

Loan-to-value ratio (Debt/Property value)

23

Properties

63

Tenants

6.6 yrs

Weighted average lease term (WALT)

PMG Generation Fund has swiftly scaled to become our second largest fund, continuing to increase in diversity by property, region and sector, while also having the largest number of tenants across any of our funds.

The Fund is part of PMG’s Reinvestment Plan, which enables investors to invest their distributions from PMG’s other funds into PMG Generation Fund, an initiative that is growing in popularity.

*Data as at 31 December 2024. Past performance is not an indicator of future results

To invest in and grow a portfolio of strategically selected directly and indirectly held commercial property assets across New Zealand, which provide building, tenant, geographic and sector diversification.

To provide ease of access to commercial property investment for more New Zealanders, so they can enjoy the benefits of regular and sustainable income with the potential for capital growth over time.

$230m

Total portfolio value

99%

Total portfolio occupancy

42%

Loan-to-value ratio (Debt/Property value)

4.7 yrs

Weighted Average Lease Term (WALT)

A sector-specific fund which owns quality office properties in main metropolitan areas across New Zealand. The fund offers excellent capital growth potential through proactive building refurbishment and strategic leasing.

The Fund includes properties with impressive sustainability credentials, including a 5.5 Star NABERSNZ Energy rating – the highest rating across

PMG’s portfolio.

*Data as at 31 December 2024. Past performance is not an indicator of future results

To target sound, well-located office properties in main metropolitan areas in New Zealand with the opportunity to add value through leasing vacant space and proactive asset management.

To grow a portfolio of quality office properties delivering sustainable cash distribution returns and growth in value over time.

$128m

Total portfolio value

86%*

Portfolio occupancy

*Reflective of two floors strategically surrendered at 213 Tuam Street. This is part of the strategy to improve diversification and income resilience.

37%

Loan-to-value ratio (Debt/Property value)

5

Properties

21

Tenants

4.2 yrs

Weighted Average Lease Term (WALT)

A sector-specific portfolio of modern early childhood education (ECE) centres,

strategically located in supportive regions across New Zealand, designed to deliver long-term value while supporting community-focused outcomes.

This sector is currently well-supported by Government funding. We closely monitor the performance of each centre, including child attendance rates and

the development of the local area compared to our expectations when purchasing a centre.

*Data as at 31 December 2024. Past performance is not an indicator of future results

To hold and grow a portfolio of early childhood education centres, diversified by region and tenant, to achieve greater resilience of income with scale.

To create long-term sustainable value for our investors and the best start for the children in our communities, through the provision of quality, fit for-purpose centres across New Zealand.

$56m

Total portfolio value

100%

Portfolio occupancy

27%

Loan-to-value Ratio (debt/property value)

11

Properties

13

Tenants

10.7 yrs

Weighted average lease term (WALT)

We understand that circumstances may change from time to time, and that investors may wish to sell their investments with us. We offer a secondary market matching service to connect those looking to buy PMG investment shares/units with those looking to sell.